For effective private fund management, a comprehensive understanding of industry best practices is essential. Implementing these strategies can significantly enhance operational efficiency and fund performance. Given the complexity of the private markets, utilizing private equity fund administration software is a critical step towards streamlined management.

The Importance of Robust Fund Management

In the realm of private fund management, robust systems and processes play a pivotal role in ensuring success. Effective fund management not only facilitates compliant operations but also improves investor relations and overall fund performance. This is particularly crucial in the U.S. market, where regulatory requirements are stringent.

Key Strategies in Private Fund Management

Implementing key strategies such as due diligence, risk management, and investor reporting is essential. These strategies help in maintaining transparency and building trust with investors. Moreover, the adoption of advanced fund administration software can greatly aid in achieving these objectives by automating and centralising operations.

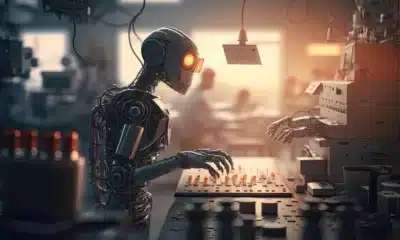

Adopting Advanced Technology

Incorporating technology into fund management practices provides a significant advantage. Advanced software solutions not only streamline operations but also offer insights through data analytics. This allows fund managers to make informed decisions and adapt to market changes quickly.

Embracing Automation

Automation is becoming increasingly important in private fund management. By automating routine tasks such as data entry and reporting, fund managers can focus on strategic decision-making and investor engagement. Automation also reduces errors, ensuring more accurate and reliable fund operations.

Enhancing Investor Communication

Effective communication with investors is a critical component of private fund management. It involves regular updates and transparent reporting, which build investor confidence and contribute to successful fund administration. Leveraging communication tools within fund administration software can enhance these efforts significantly.

Regulatory Compliance

Adhering to regulatory requirements is non-negotiable in private fund management. Compliance ensures that funds operate within legal frameworks and are protected from potential legal and financial penalties. Staying updated with the latest regulations and employing compliant practices are fundamental for sustaining fund operations.

Risk Management Practices

Risk management is a cornerstone of successful private fund management. Identifying and mitigating potential risks helps in safeguarding fund assets and achieving strategic objectives. This requires a proactive approach and the utilisation of tools that offer risk assessment and mitigation features.

Cost Management for Profit Maximisation

Efficient cost management strategies are vital for maximising profits in private fund operations. Keeping operational costs in check while investing in areas that enhance revenue should be a primary focus for fund managers.

Data-Driven Decision Making

Data analytics play a crucial role in enhancing fund management strategies. By leveraging data, fund managers can gain insights into market trends and investor behaviours, enabling more informed decision-making processes.

Customised Solutions for Different Funds

Each fund has unique requirements, necessitating customised management solutions. Tailoring strategies to fit specific fund needs ensures more effective and efficient fund administration.

The Role of Experienced Personnel

Human expertise remains invaluable in private fund management. Experienced personnel bring insights and strategic thinking that technology alone cannot provide. A skilled team is essential for navigating complex market dynamics and delivering successful outcomes.

Building Long-Term Relationships

Developing and maintaining long-term relationships with stakeholders is crucial for sustainable fund success. Trust and reliability are built over time, providing a solid foundation for continued investment and growth.

Future Trends in Private Fund Management

The future of private fund management is likely to be shaped by continued technological advancements and evolving regulatory landscapes. Remaining adaptable to these changes will be key for fund managers looking to thrive in this sector.

Conclusion

In conclusion, adhering to best practices in private fund management is imperative for optimising operations and delivering value to investors. By integrating technology, enhancing communication, and focusing on compliance and risk management, fund managers can effectively navigate the complexities of the private market in the U.S.

Health2 years ago

Health2 years ago

News5 months ago

News5 months ago

Technology2 years ago

Technology2 years ago

Celebrity2 years ago

Celebrity2 years ago